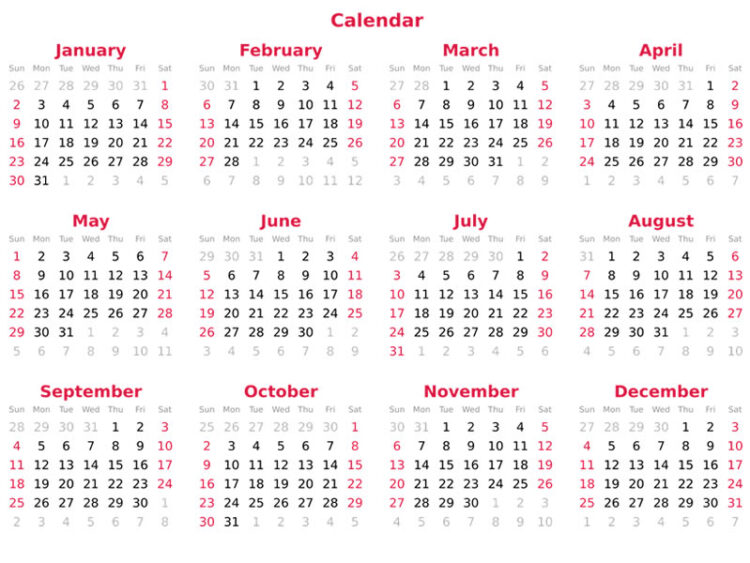

Below comes a useful tax diary with the most important dates for the year 2022

End of each month

- Payment of PAYE deducted from employees’ salaries for the previous month (TD 61A form).

- The Payment of Social Insurance contributions and GESY (Cyprus General Healthcare System) deducted from employee’s salaries for the previous month.

- Payment of special contribution for defense deducted from dividends, interest, or rent paid for the previous month. Companies, partnerships, the Government, or any local authority that pays rent, have the obligation to withhold special defense contribution on the amount of the rent paid (TD 601, TD 602, TD 603 forms).

- Payment of tax withheld in the preceding month on payments to non-Cyprus residents (TD11).

31 January

- Submission of the deemed dividend distribution declaration (TD623) for the tax year 2019.

31 March

- Electronic submission of the 2020 income tax return of companies (TD4) and self-employed individuals (TD1) preparing audited financial statements.

30 April

- Payment of premium tax for life insurance companies – first installment for 2022 (TD199).

31 May

- Electronic submission of employers’ returns and employees’ details for 2021 (TD7).

30 June

- The Payment of special contribution for defense and GESY in relation to dividends or interests from sources outside Cyprus for the first half of 2022 (TD 601 form).

- Payment of special contribution for defense and GESY in relation to gross rents (less 25%) from sources within or outside Cyprus for the first half of 2022 (TD 601 form).

31 July

- Electronic submission of 2021 personal income tax return (TD1) by individuals and payment of 2021 personal income tax liability

- Submission of the 2022 provisional tax return and payment of the first installment of 2022 temporary tax (TD5, TD6).

1 August

- Payment of 2021 tax liability through self-assessment by companies and individuals preparing audited accounts (TD158 form).

31 August

- Payment of premium tax for life insurance companies – second installment for 2022 (TD199).

31 December

- Submission of the 2022 revised provisional tax return (if applicable) and payment of the second installment of 2022 temporary tax (TD5, TD6).

- The Payment of special contribution for defense and GESY in relation to dividends or interests from sources outside Cyprus for the second half of 2022 (TD 601 form).

- Payment of special contribution for defense and GESY in relation to gross rents (less 25%) from sources within or outside Cyprus for the second half of 2022 (TD 601 form).

- Payment of premium tax for life insurance companies – third and last installment for 2022 (TD199).

Within 30 days

- Payment of Capital Gains Tax.

- Issue invoices within 30 days from the date of the transaction.

- Payment of stamp duty.

Within 60 days

- Companies must obtain a Tax Identification Code (TIC) within 60 days from incorporation with the Registrar of Companies. This also applies to companies incorporated abroad that become tax residents in Cyprus (TD 162 form).

- Companies must notify the Inland Revenue of changes to their details (eg change in registered office etc) within 60 days from the change (TD 162 form).

Four months from the end of the transaction

- Books and records of a business that is obliged to keep accounting records must be updated within 4 months from the date of the transaction.

At the end of the financial period

- Companies that have inventory must perform an annual stock take around the year-end.

Within the timeframe specified by Inland Revenue

- Submission of information that has been requested in writing by the Inland Revenue.

Administrative Penalties and Interest

Penalties amounting to €100 or €200 depending on the specific case will be imposed for late submission of declarations or late submission of supporting documentation requested by the Commissioner.

In the case of late payment of the tax due, an additional penalty at the rate of 5% will be imposed on the unpaid tax. An additional penalty of 5% is imposed if the tax remains unpaid 2 months after the payment deadline.

The interest rate for late payment of tax is determined by the Minister of Finance through a Decree and it is applicable for the whole year. The rate for 2022 was set at 1.75%.